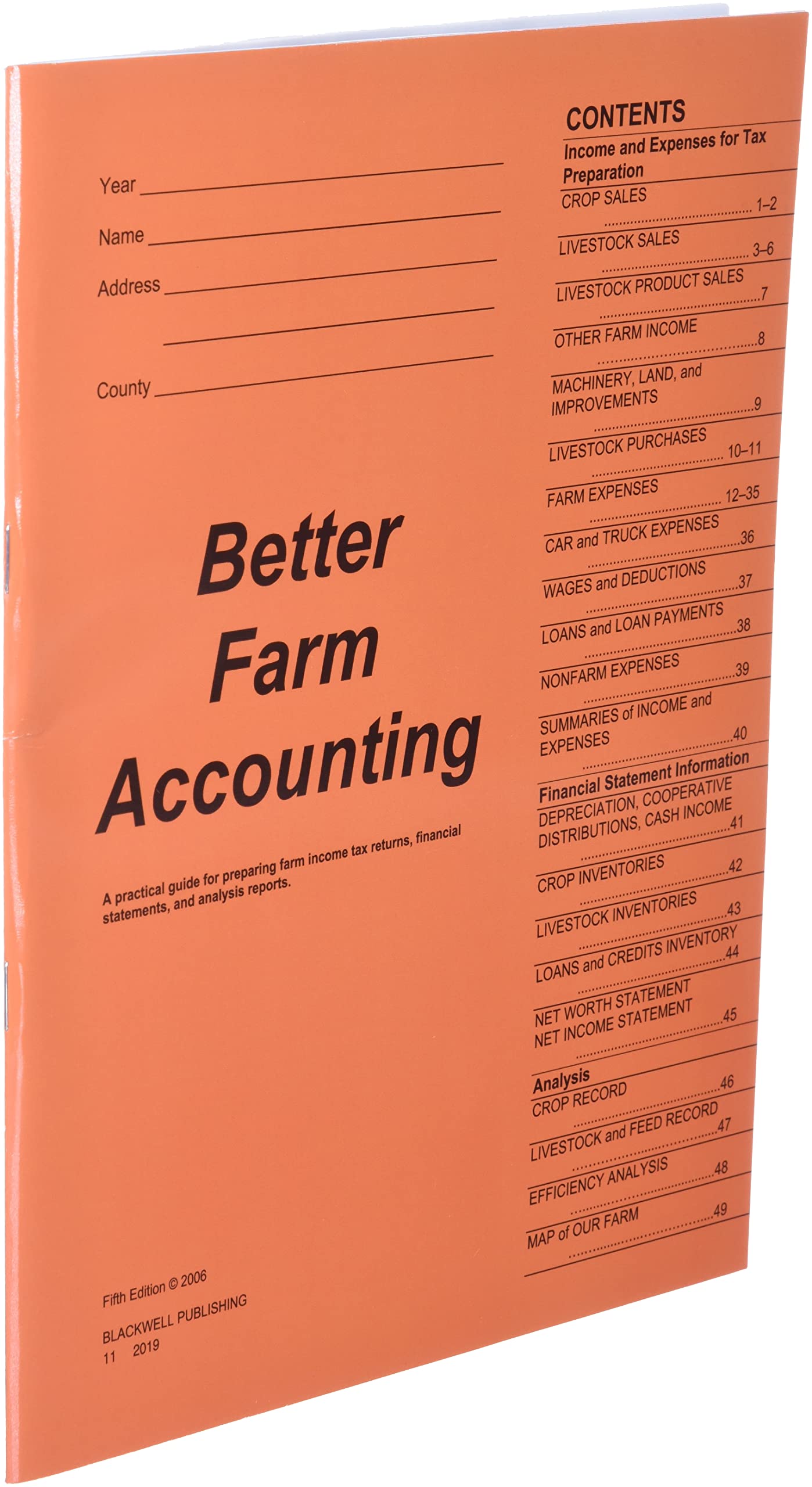

Better Farm Accounting: A Practical Guide for Preparing Farm Income Tax Returns, Financial Statements, and Analysis Reports

P**R

Has a very usable format

How are use this record book for 40 years has served me well. A good reference to look back on also.

A**O

Works for me!

I just ordered my 3rd and 4th book. I've used this book the last 2 years and love it. The set-up in this book works well for me.

J**Y

Not applicable

Was not suitable to my needs

C**S

Recording expenses for your farm

This is a book for recording your farm expenses, organized so as to help you with your taxes. Looks very useful, but you would need a new one each year. Not a "how to" book, but a learning experience. If you work through it, it does answer your questions as to what is tax deductible.I think it would be very useful for anyone with any sort of farm, big or small -- even a market garden. Also for those in the planning stage. Of course, you will never use all the categories (unless you have an extremely diversified large farm), but that's OK.

B**B

Perfect,

I will not be without these, it helps keep my farm expenses in order and in one place. Very nicely organized and simple, and I like that I need a new one each year.

M**L

Pencil/Paper Farmer

My husband is still a pencil/paper farmer! This makes it easy for me to transfer records to the computer!

C**A

Not a guide you'll need

All this booklet contains is column paper. No guides, lists, etc. All this does is give me a place to hand-write my information. So not necessary in a computerized world. As an accountant, I can't remember the last time I used column paper. If accounting software doesn't have it, I can create it in Excel.This was a waste of money.

C**N

Helpful

This book has been extremely helpful in keeping our farm records in order. I would recommend it to anyone in the farming business.

C**H

Not what I thought.

Would not purchase.

Trustpilot

1 week ago

1 day ago